When a corporation keeps its books, the accounting papers are recorded. The accounting records can take a variety of formats (buy invoices, sales invoices, bank statements), but they must all be appropriately filed. Compta-Facile explains the best practices to follow in this area and answers the question of how to classify accounting records.

Accounting Documents to be Classified

Traditionally, all documents that are the subject of an accounting register must be classified; this includes, but is not limited to, the following:

- Payslips

- Payroll slips

- Yearly declarations

- Bank statements

- Bank transaction receipts

- Cash registers receipts

- Purchase invoices and sales invoices

- Tax declarations (VAT declarations, corporate tax declarations, etc.).

Accounting document filing has an indisputable benefit: it contributes to a company’s effective management and reduces the chance of becoming lost in its books. It allows a corporation to quickly retrieve a supplier or customer invoice, saving a lot of time.

The Format of the Accounting Documents to be Filed

Classification can be done:

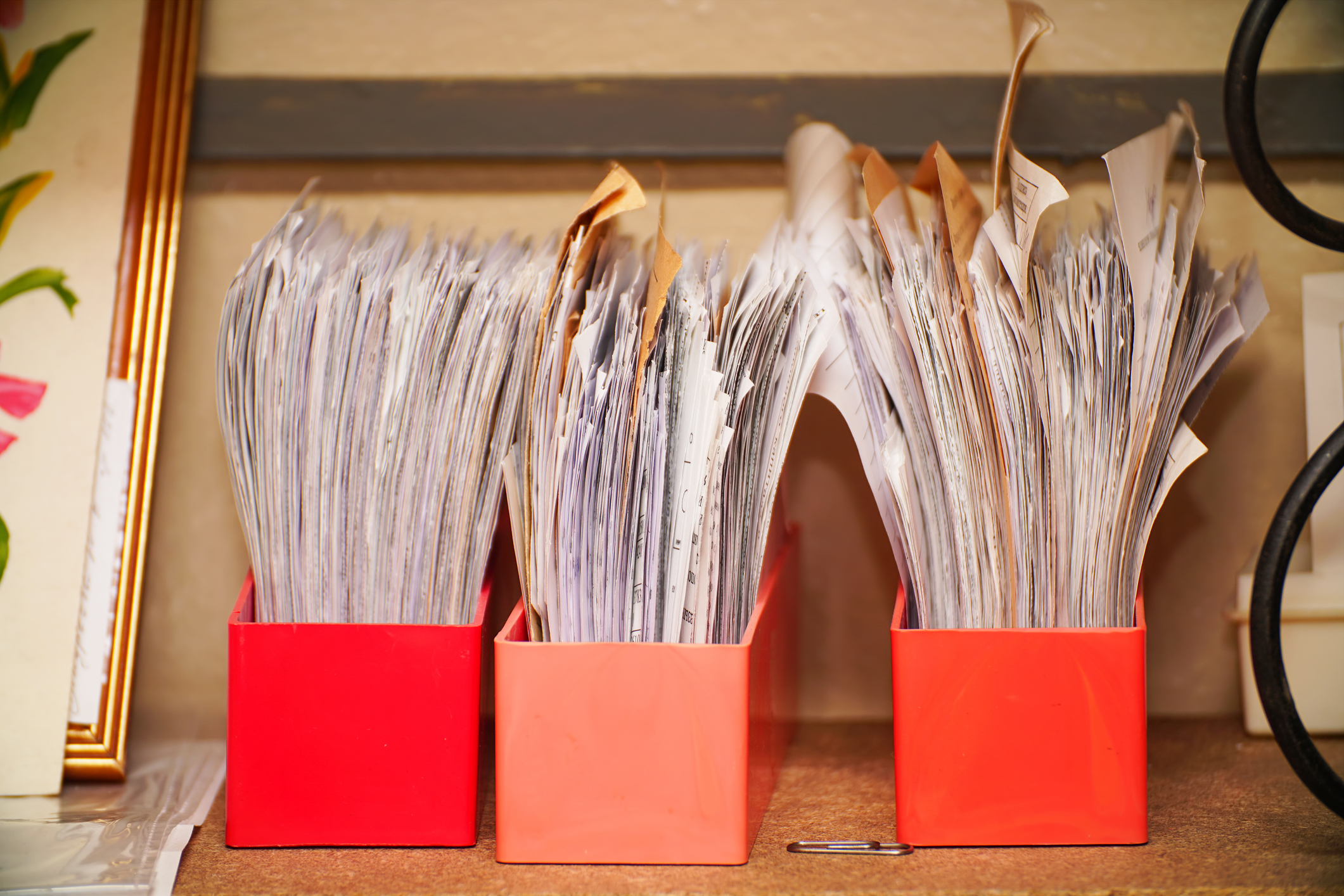

In paper format

In this instance, it’s best to use workbooks that correspond to the company’s accounting journals. It’s vital to pay particular attention to the storage/archiving site so that the quality (moisture) of the documents is kept and only a few people have access to them. If a corporation keeps a “purchases” journal, a “sales” diary, and a “bank” journal, for example, it will utilize three binders with the same name and the same supporting documentation for each journal.

In dematerialized training

Accounting records are digitized and kept in secure locations. The organization must safeguard against data loss (by storing backups on external hard drives or CDROMs, for example) and restrict access to this sensitive information. Keeping the originals in paper format is still strongly recommended.

The method of filing accounting documents

A decent filing system should allow you to locate a receipt using the account number quickly.

There are many ways to classify accounting documents, depending on the frequency of entry and the company’s specific characteristics. Classification is one of the most used techniques.

First and foremost, a classification of accounting records according to their purpose (purchase, sale, bank). To ease the accounting entry process, you can categorize them before being recorded in the accounts, for example, in ascending chronological order. They can be filed straight in different workbooks when they’ve been accounted for:

- Purchase invoices are filed in a “Purchases” binder,

- Sales invoices are filed in a “Sales” workbook,

- Bank statements are filed in a “Bank” binder,

- Crate fogs are filed in a “Crate” binder,

- Payroll journals and payroll slips are filed in a “Payroll” binder,

- VAT returns are filed in a “VAT” workbook,

- etc.

Companies permitted to use cash accounting may use a different manner of filing accounting papers. The latter can staple the supporting documents for all the transactions indicated in the bank statement in chronological order behind each one.

The accounting records should then be numbered according to a coding system that is unique to the organization. As a result, the accounting department assigns a number to the supporting document (generally supplier/customer invoices), enters it (indicating the number it has given to the supporting document in the “document number” column), stamps it with an “accounted for” stamp, and places it in his binder.

In actuality, the numbering might be based on a series of numerals (for example, 001, 002, 003, etc.) or other factors, depending on the company’s entry frequency (for example, for an invoice of purchase dated May 2018, if the company uses month-by-month dividers with a number reset to zero every month: “2018-05-001”). The company will be able to use the same numbering system for sales invoices as it does for invoicing (by entering the number carried by its invoice in the “document number” column of its accounting software). For banking transactions, you may keep the number of the check remittance and the number of the check issued.

Conclusion

Proper classification of accounting papers is required to ensure appropriate firm administration and operation monitoring. Accounting papers are numbered to make it easier to reconcile an accounting entry with its supporting documentation.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.