I do not know if you identify with me, but I have tried hundreds of times to start a budget and I never manage to keep it the way I expected.

Unforeseen expenses, calculation errors, loss of money, income less than what was expected, etc. They destroyed my budget within days or weeks of having started, throwing me into frustration over and over again.

The strange thing is that, for the most part, each year I earned more money than the previous one. However, financial tension always existed from day one.

Until I learned to make a budget in the right way. That’s why today I want to give you 4 secrets that will lead you to manage a budget in the right way. One that FINALLY! It will work for you.

SECRET # 1: Build a Budget to Zero

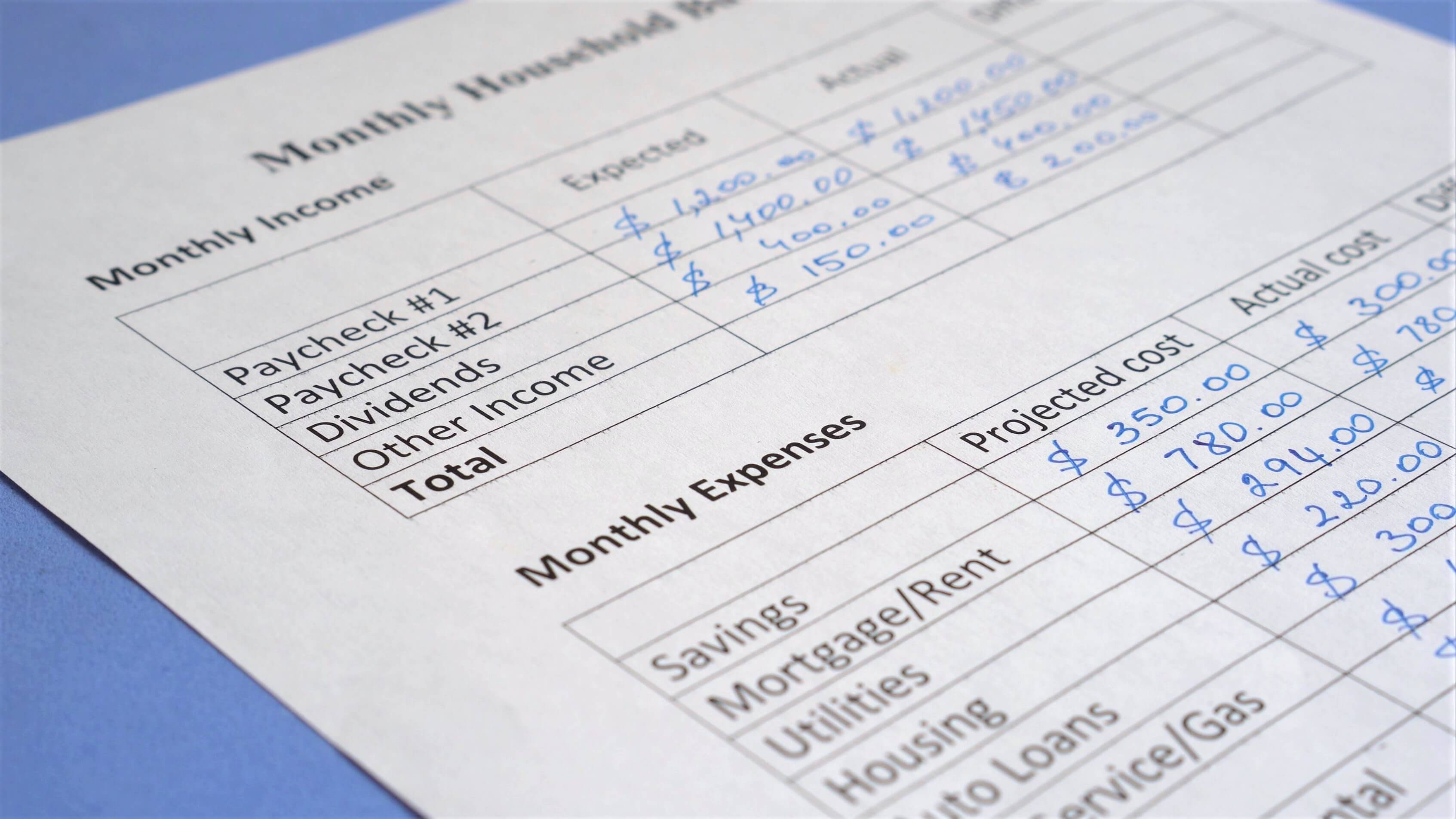

Also called “give a job to every dollar you earn”, means that the correct way to make a budget is that every dollar needs to have a reason. You can not have money left over in your budget. Whether you decide to save, invest, spend or give away, you need to assign a reason to each dollar and the sum between your income minus your expenses always has to equal zero.

SECRET # 2: Save $ 1,000 to Start

This is what my friend, Andrés Gutiérrez calls the “emergency mini-fund” or what I call “the fund for rainy days”. This $ 1,000 is recommended if you live in the US (In other countries it is different: Spain – $ 1,000 Euros, Mexico – 5000 pesos, Colombia 650,000 Colombian pesos, Argentina – 2000 pesos, Peru – 600 soles, etc.).

This fund is going to be the key to keeping your budget and financial plan in line when life kicks you out. And believe me, life always kicks.

SECRET # 3: Adjust Daily or Weekly

One of the big mistakes in managing a budget is that we see it as a static document. The reality is that a budget is a dynamic document.

Did you have an unforeseen expense for your child? Is medicine a little more expensive than you budgeted? Then you need to adjust your budget and reduce other categories so that the budget always adds up to zero. (Example: you decrease the budget of restaurants in that month to adjust for the rise of the medicine).

SECRET # 4: Plan for Events that are Repeated Every Year, and Save Monthly for Them

We all have unforeseen events. But Christmas, our family’s birthday, property taxes, holidays are not unforeseen. These situations happen every year.

The secret is to calculate the estimate of each of them, divide the total between twelve months, and save that amount monthly. That way, on your husband’s or wife’s birthday, you can go to that account and buy something beautiful without remorse. Also your son will have the birthday party he asked for and your family will go on vacation without stress … and none of that will affect your monthly budget or your cash flow.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing services to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud-hosted desktop where their entire team and tax accountant may access the QuickBooks file, critical financial documents and back office tools in an efficient and secure environment. Complete Controller’s team of US based accounting professionals are certified QuickBooks™️ ProAdvisor’s providing bookkeeping, record storage, performance reporting and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay services. With flat rate service plans, Complete Controller is the most cost effective expert accounting solution for business, family office, trusts, and households of any size or complexity.