When using a checkbook, it is essential to keep it balanced. Balancing a checkbook requires simple addition and subtraction details. It is done by recording all transactions made to your account, similar to being your bookkeeper. Transactions can be of two types: deposits and withdrawals, which affect your addition and subtraction. Checkbook balancing is done to know how much money is in your bank account so that decisions related to the account (such as writing a check or making an ATM withdrawal) are made without error.

Checkbook Register

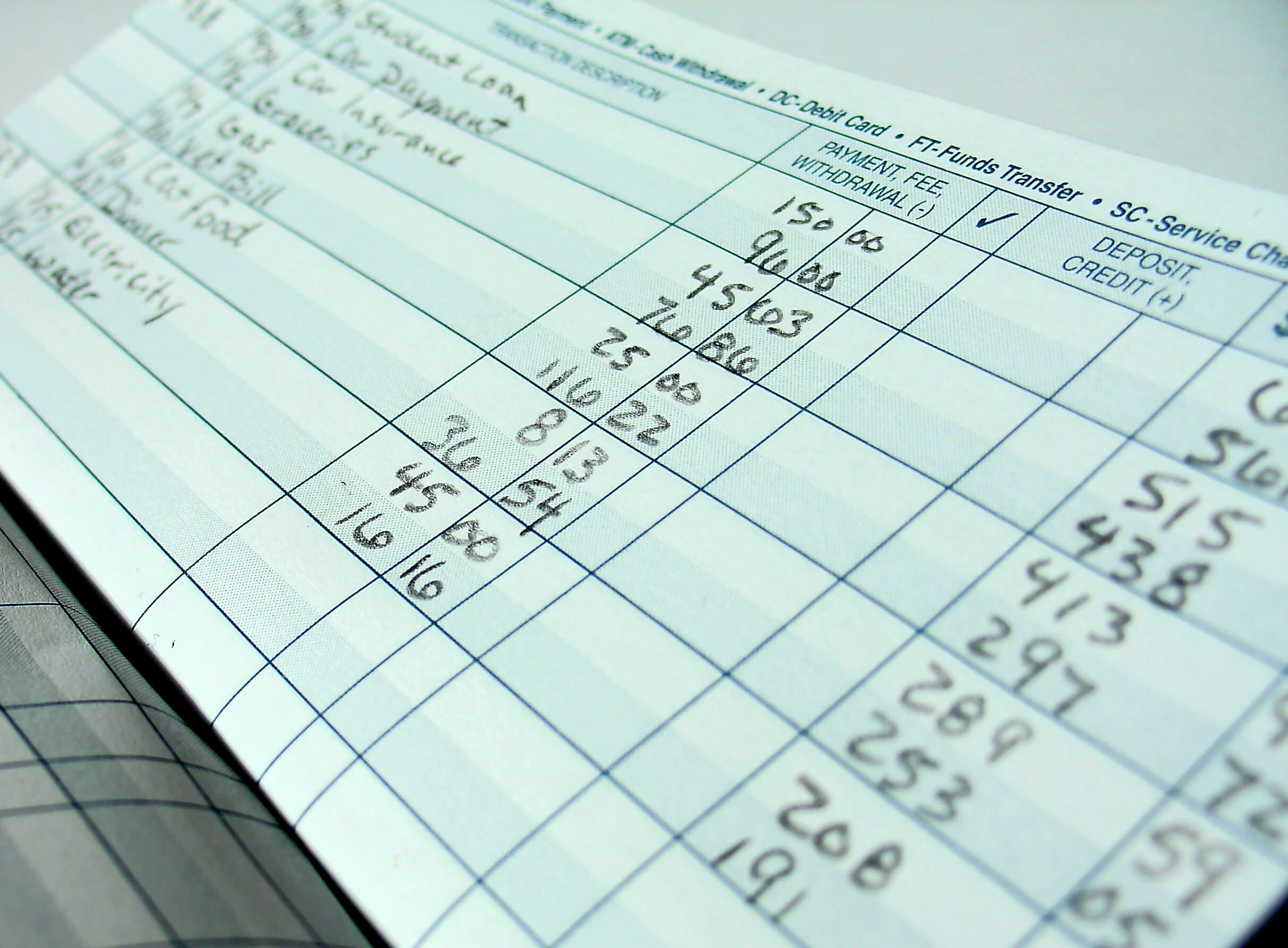

To balance your checkbook, you need to write out all transactions; this is done in a register given within the checkbook.

Usually, a checkbook register has the following six columns:

- Number: In this column, you will record the check number. This refers to the particular check involved in the recorded transaction.

- Date: This column is provided to record the date of the transaction.

- Description: This column records the transaction details, such as who the check is written to or perhaps information on withdrawing cash using your debit card at an ATM.

- Amount (Debit): You’ll need to record the payment, check, or withdrawal amount in this column.

- Deposit: This column is for recording deposits, including paychecks, payments from clients, or money that may have been transferred from some other account.

- Balance: This column denotes the amount of money left in your account after any particular transaction. This starts with your account’s opening balance and is altered by additions related to deposits and deductions related to withdrawals.

Bounced Check – A Big No-No

If the balance in your checking account is low, it is essential to record and calculate all of your transactions accurately. Doing so will help you avoid bouncing a check you sign and submit for payment.

What is a Bounced Check?

If your bank declines to carry out a transaction instructed by a check you issued, it is termed bounce (be returned). This happens when the check asks for an amount that is more than the money you have in your account. It is true that if our check bounces, it can be an embarrassing situation. However, it can be costly because the bank charges you a fee to compensate for a failed clearing process whenever a check is bounced. You can avoid this embarrassing and expensive situation by bookkeeping in the checkbook register.

Note: Another way to avoid a bounced check is to opt for a bank overdraft if your bank offers this service. This service involves the bank accepting checks with a value higher than your account balance. Be alert if you have opted for an overdraft, as the bank charges a high interest rate when you exceed your account balance and an overdraft fee.

Why Balance Your Checkbook?

You might wonder, why go through the hassle of maintaining a checkbook register if you can get an update on your balance at an ATM or online? The reason is that these services will not tell you about your outstanding checks (checks that you’ve written but haven’t been processed by the bank) and, thus, would be giving a number higher or lower than the actual available account balance.

Forgetting to Record Transactions

This is the most common mistake people make when balancing a checkbook. This is because many people make card payments and ATM withdrawals and forget to record them in their register because of time. An account statement indeed provides such information, but one thing to remember is the possibility of you having to write new checks before that statement comes in. The primary purpose of maintaining this book is to avoid having any of those checks bounce.

As said before, keeping your checkbook register organized and updated can help you avoid bouncing checks and using overdraft protection because you will know how much money is available for spending in your account. This is especially true for people with a low account balance at the end of the month and people who frequently write checks.

Tip: You can get a cover for your register with a calculator to avoid any mathematical errors.

You can compare your register with the account statement you get (when it comes in). This helps amend your checkbook register to include the transactions you might’ve forgotten to record. About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.