Every responsible adult should consider creating a budget to manage household finances. Surprisingly, many adults don’t have a budget or monthly financial plan. Often this leads to poor money management because there is no accounting for expenses in comparison to income. Here are some tips to help you achieve your financial goals to gain control of your household finances.

Start Planning

It is necessary to have a financial plan to help you manage household finances. Financial planning includes various phases. The first phase is deciding how to control your budget and then create a spending plan that encompasses repayment of the debt, saving an emergency fund, and another financial goal setting. At this point, you need to prioritize your finances according to what’s most important for you financially. Here are three points to focus on when making your plan specifically regarding your household finances.

- Creating and sticking to a budget is the key to success.

- Contribute monthly to your financial goals

- Build an emergency fund

Create and Stick to a Budget

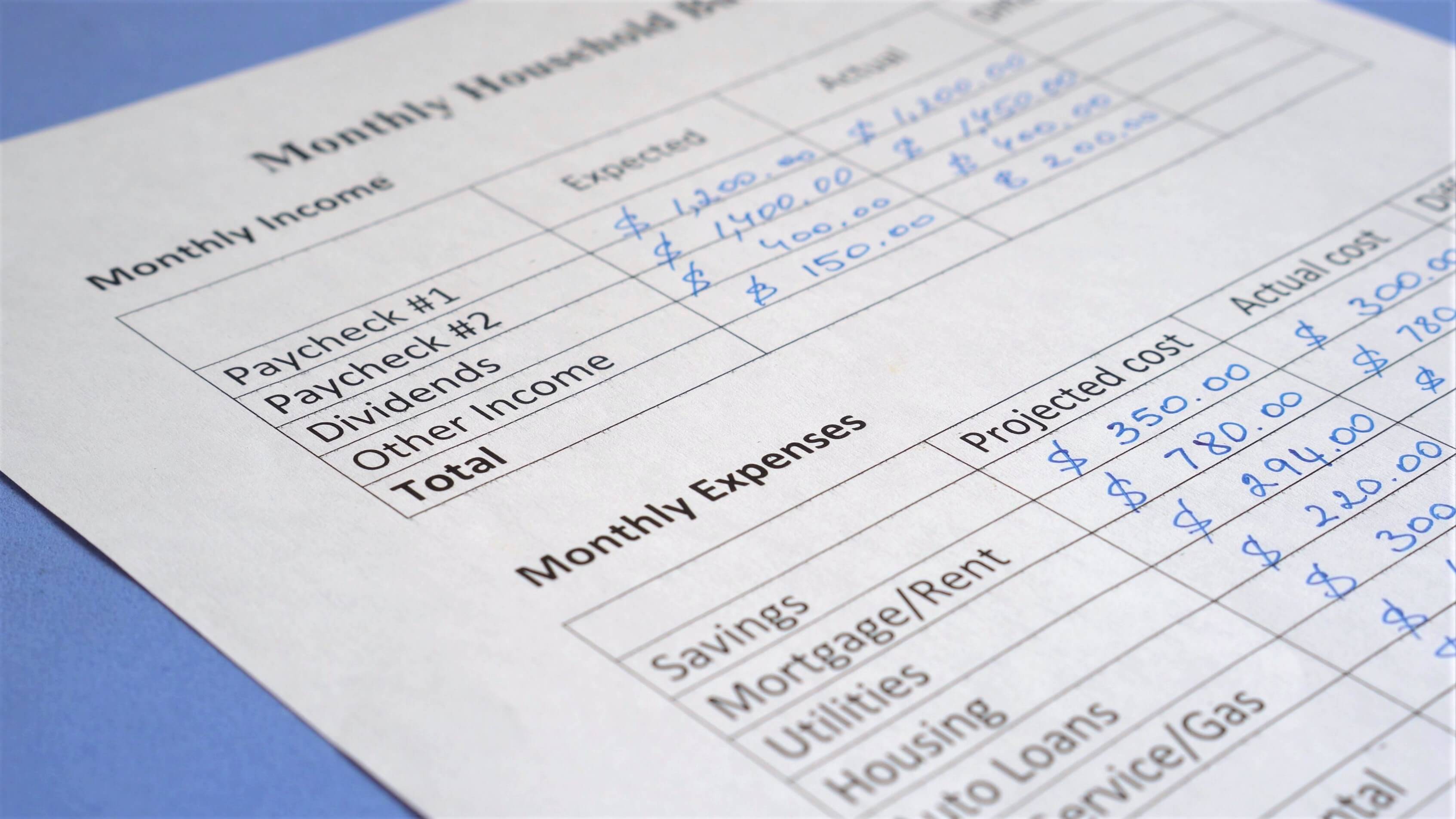

Creating an honest and realistic budget is imperative. You must gather all your income sources and list all your expenses, down to the smallest detail. Once you have an honest accounting of your income and expenses, you need to analyze your expenses. Determine your fixed expenses, your necessities, non-necessities, and impulse spending. Now comes the hard part. It would be best if you cut as many non-essential expenses as you can. You don’t have to give up every non-necessity, but the more you can eliminate, the closer you will get to getting your household finances under control.

Once you have eliminated the expenses you can live without, allot a monthly amount towards savings. Put as much money towards savings as you can though experts in finance say that it should be at least 10% of your net income. Experts also say you should pay yourself (put money in savings) first, pay bills, and then non-essentials you choose to keep. Unless an emergency comes up before you have an emergency fund saved, do not deviate from this budget. This will take discipline.

Avoid Unnecessary Bank Charges

A few years ago, it was reported that bankers in New York celebrated the billions they made from bank fees. While it is understandable that you will make a mistake at times, you must spend within your means to avoid the high bank overdraft fees. These can snowball and add up to financial devastation. If you make a mistake, call your bank right away, most banks will forgive a fee or two once in a while, so always call to see if you can get the fee(s) waved.

There are other fees to try to avoid. Some bank accounts charge fees if you dip below a certain balance. Choose an account or bank that does not charge a minimum balance fee. Also, some banks will reimburse ATM fees and other fees. When choosing a bank or bank account, do your research.

Prioritize Debt

When it comes to debt, it is important to prioritize your debt. You need to list your debts by the highest amount and highest interest rate. Credit cards with high-interest rates and loans should be a priority to pay down as quickly as possible. If you have to do without that latte and tighten the belt on entertainment and extras while paying these high-interest debts off, you have to do. Many Americans suffer from overwhelming debt and, in some cases, never come out from under it before incurring more. Most importantly, do not take out a loan or use credit cards to pay down debt. Cut expenses or get another stream of income but don’t get in further debt to pay the debt.

Conclusion

Managing your household finances isn’t difficult but does take focus and determination. Start planning, create and stick to a budget, avoid unnecessary bank charges, and prioritize debt, and you will get your household finances under control and even have money for savings!

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud-hosted desktop where their entire team and tax accountant may access the QuickBooks™️ file, critical financial documents, and back-office tools in an efficient and secure environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud-hosted desktop where their entire team and tax accountant may access the QuickBooks™️ file, critical financial documents, and back-office tools in an efficient and secure environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.