When managing the finances, it is best to have a clear picture of all financial concepts, including simple and compound interest. Simple interest is easily understandable by all. It works simply with the principal amount, and a fixed rate of interest is paid or earned after fixed time intervals. Things get complicated under the light of the compound interest.

What is compound interest?

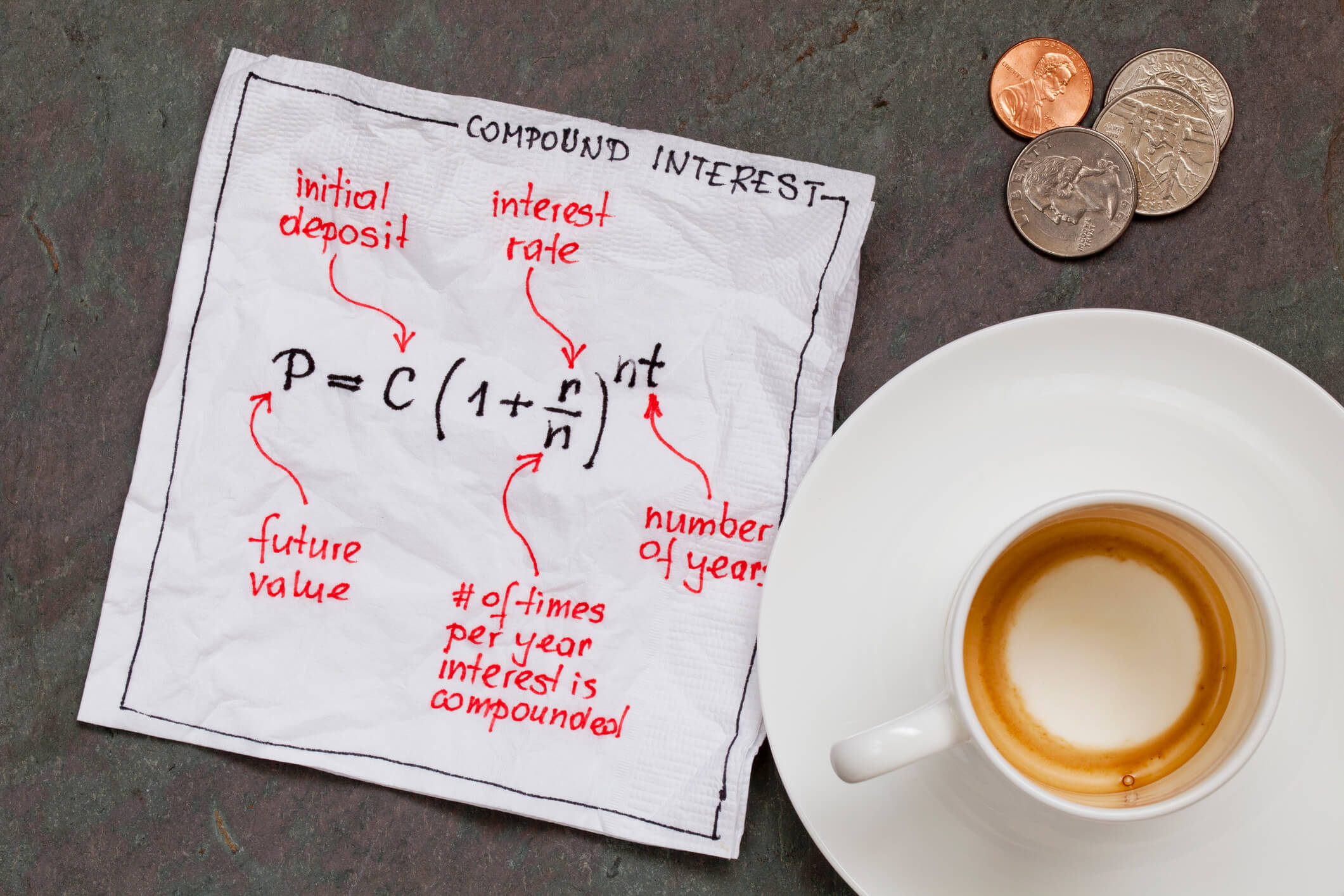

Unlike simple interest, compound interest applies to the sum of the initial principal amount and the accumulated interests from the start on loan or a deposit. In the case of a deposit, it can work miraculously in growing the deposit. While in the case of repayment of the loan, if not paid regularly, an individual ends up paying way more than the initial amount. The amount earned or paid at the end depends upon the length of the compounding period. The amount payable at the end of the compounding period of two years will be lower than the amount payable at the end of a compounding period of five years.

Working of compound interest

Interest applied on previously earned interest is the perfect way to define compound interest and its working. It is a continuous cycle, and it paves the way for the exponential growth of the principal deposited amount.

To understand the working of this concept, take an example of a person who deposited $100 in the bank at an interest rate of 5%. At the end of the first interest period, the person earns $5 over the deposit. A person will keep earning a fixed amount of $5 at the end of every interest period in simple interest. But in compound interest, the person will make $5 over the first period. Over the next period, the person will not earn interest on the principal amount of $100, but it will be applied to $105 instead.

That is why compound interest works wonders for people who deposit their savings in the bank and works against the borrowers. It is because, with time, the principal amount will increase if there is a slight error in estimation. Borrowers end up paying way more than they borrowed.

Perfect use of compound interest

The working of compound interest is greatly beneficial if used in the right manner. Here are ways through which people can ensure that it works in their favor.

Starting early savings

Compound interest is an ideal saving technique for people who have the patience to leave their money untouched for a long time. The first two to three interest periods will not bring big returns, but with time people can earn huge amounts just by keeping their money in one place. The earlier a person starts saving, the higher will be the amount earned at the time of retirement. It also covers the period during which a person fails to save due to increased monetary burdens.

Debt payment

People who have borrowed a loan with compound interest smartly dealing with it can help them pay with much ease. Borrowers must try to pay extra payments if their budget allows. It helps in preventing the balance from growing and helps in a quick repayment of debts. Another way to handle compound interest smartly is to keep the amount borrowed amount as small as possible.

A smart move for savers is to deposit the amount saved in the banks. Without putting in any effort, they will be able to earn money on their saved amount. Time is key; therefore, the longer these savings are kept in a bank, the higher the returns will be. So being patient and allowing the returns to mature is the best option.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.