Productivity

When you have more days off from work, you have more time to focus on what matters most. For example, if an important project at work is due in two weeks and it’s taking up too much of your time now because of deadlines and other commitments, this can be a good thing!

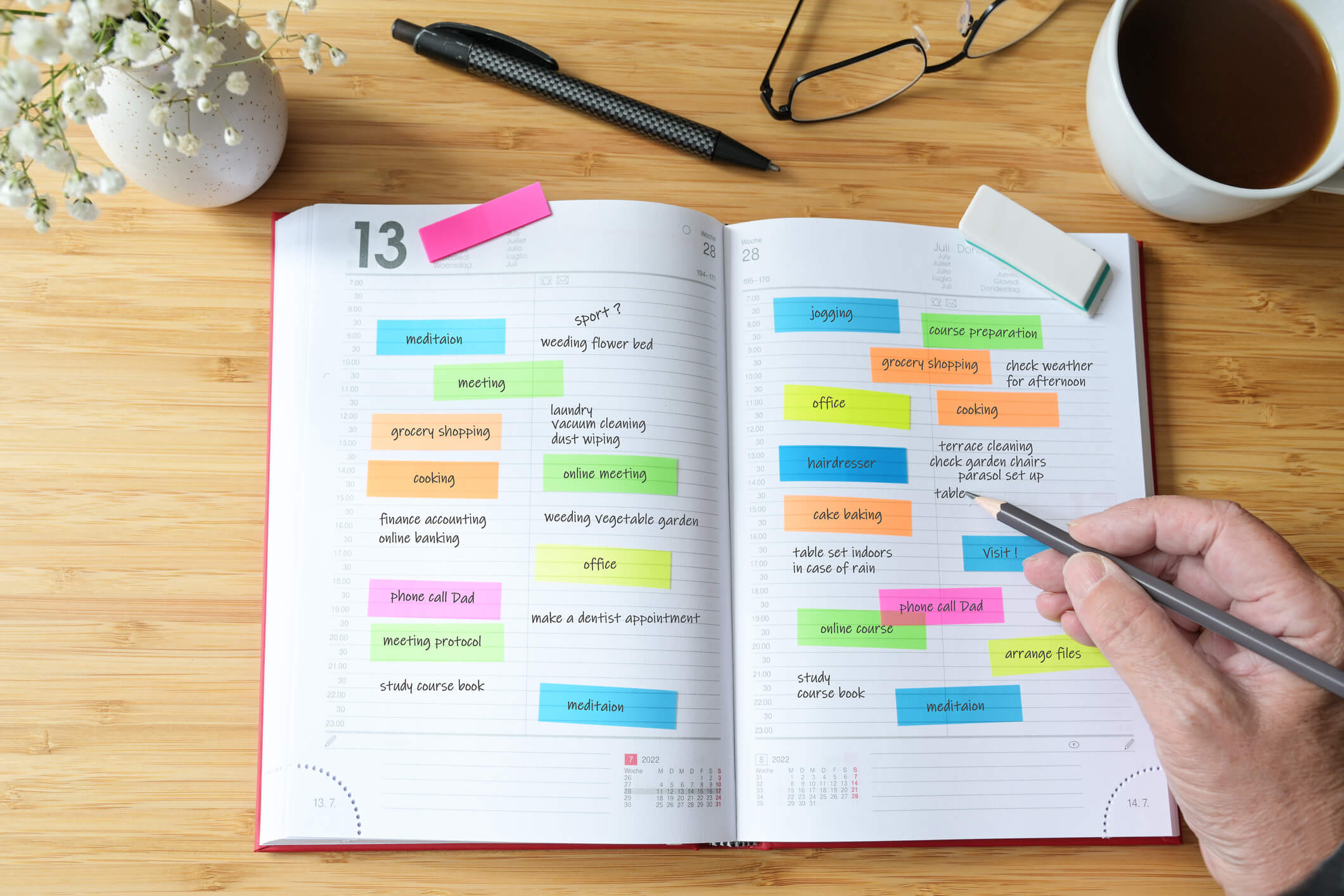

More time for planning, organizing, and prioritizing.

When the four-day work week becomes standard practice for many businesses (and employees) around the world today, those who use this method will suddenly find themselves with more leeway than ever before when it comes to making decisions about their careers or personal lives. So, there’s less pressure from outside sources such as bosses or parents since they’re no longer being micromanaged by everyone else every single second of every day! It also means that each employee has more control over how much they work each day because there isn’t anyone else telling them otherwise. Therefore, they can make choices based on their own needs rather than those imposed upon them by someone like another boss.

When the four-day work week becomes standard practice for many businesses (and employees) around the world today, those who use this method will suddenly find themselves with more leeway than ever before when it comes to making decisions about their careers or personal lives. So, there’s less pressure from outside sources such as bosses or parents since they’re no longer being micromanaged by everyone else every single second of every day! It also means that each employee has more control over how much they work each day because there isn’t anyone else telling them otherwise. Therefore, they can make choices based on their own needs rather than those imposed upon them by someone like another boss.

- Healthier employees and lower healthcare costs

- Less stress, burnout, and fatigue

- It improved employee satisfaction

- It reduced sick days

- Lower healthcare costs (and less time at work)

- More time for family, exercise, and hobbies, or just plain old sleep

- Less burnout, less stress

Burnout and stress are significant problems in the workplace. Burnout is associated with many adverse outcomes, including increased absenteeism, lower productivity, and employee engagement. Stress also has an impact on employee health: stress can lead to illness and absenteeism, which can have a significant effect on your business.

As you might imagine, these issues are costly for companies financially (in terms of lost revenue) and emotionally (how much do employees care about their job?). In fact, employees who feel valued by their employers are more likely to stay with the company longer than those who don’t feel valued.

More Energy

A lot of people don’t realize that they have the potential to be more productive and happier at work when they work fewer hours.

Employees will be happier because they’ll have more time to spend with their families and friends, which means they’ll be able to spend more quality time with them. They won’t be working long hours every day or week, so this gives them the chance to take care of themselves in other ways besides just being focused on their job duties (which can make us feel tired).

In addition, employees who feel confident about their abilities tend to do better and enjoy themselves more! It means less stress from trying hard all the time–and it just feels good knowing if something doesn’t go according to plan, then there isn’t any pressure because no one cares about what happens anyway.

It Improved Employee Satisfaction

The four-day workweek is a big win for employees. It gives them more time to spend with family and friends, pursue new interests, do things they enjoy (or do not hate), sleep, and exercise.

In addition to these benefits, a four-day workweek improves employee satisfaction by giving them more time to focus on their job rather than worrying about finding enough money or working long hours.

- The four-day workweek can be good for you and the company.

- The four-day workweek can help improve productivity, health, and employee satisfaction.

- The four-day workweek is an excellent way to reduce stress and burnout and improve employee happiness.

- The four-day workweek is a good way for companies to reduce healthcare costs by reducing the number of workers who need medical attention each year.

Conclusion

The 4-day work week is a fantastic strategy to lower stress and boost output.

A 4-day work week allows you to accomplish more in less time. You’ll have more free time to rest and concentrate on your personal affairs, giving you more energy to work hard the next two days.

Your schedule can be more flexible if you work a 4-day week. Because you won’t be as hurried, you’ll be able to plan more effectively and avoid missing any significant deadlines or occasions.

Finally, the 4-day work week can help employers save money by minimizing the overtime staff members must put in on the weekends or during times when their hours overlap. About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.

About Complete Controller® – America’s Bookkeeping Experts Complete Controller is the Nation’s Leader in virtual bookkeeping, providing service to businesses and households alike. Utilizing Complete Controller’s technology, clients gain access to a cloud platform where their QuickBooks™️ file, critical financial documents, and back-office tools are hosted in an efficient SSO environment. Complete Controller’s team of certified US-based accounting professionals provide bookkeeping, record storage, performance reporting, and controller services including training, cash-flow management, budgeting and forecasting, process and controls advisement, and bill-pay. With flat-rate service plans, Complete Controller is the most cost-effective expert accounting solution for business, family-office, trusts, and households of any size or complexity.